do you pay taxes on a leased car in texas

This means you only pay tax on the part of the car you lease not the entire value of the car. In the state of Texas any leases lasting for greater than one hundred and eighty days are considered to be exempt from the general sales and use tax but will be subject to any motor.

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

In most cases yes youll still have to pay sales tax when you lease a new car but this could vary depending on where you live.

. Depending on where you live leasing a car can trigger different tax consequences. There is no personal property tax on leased vehicles in Virginia. If youre leasing a car as a private individual through a personal lease you will be required to pay VAT value-added tax at a fixed rate of 20.

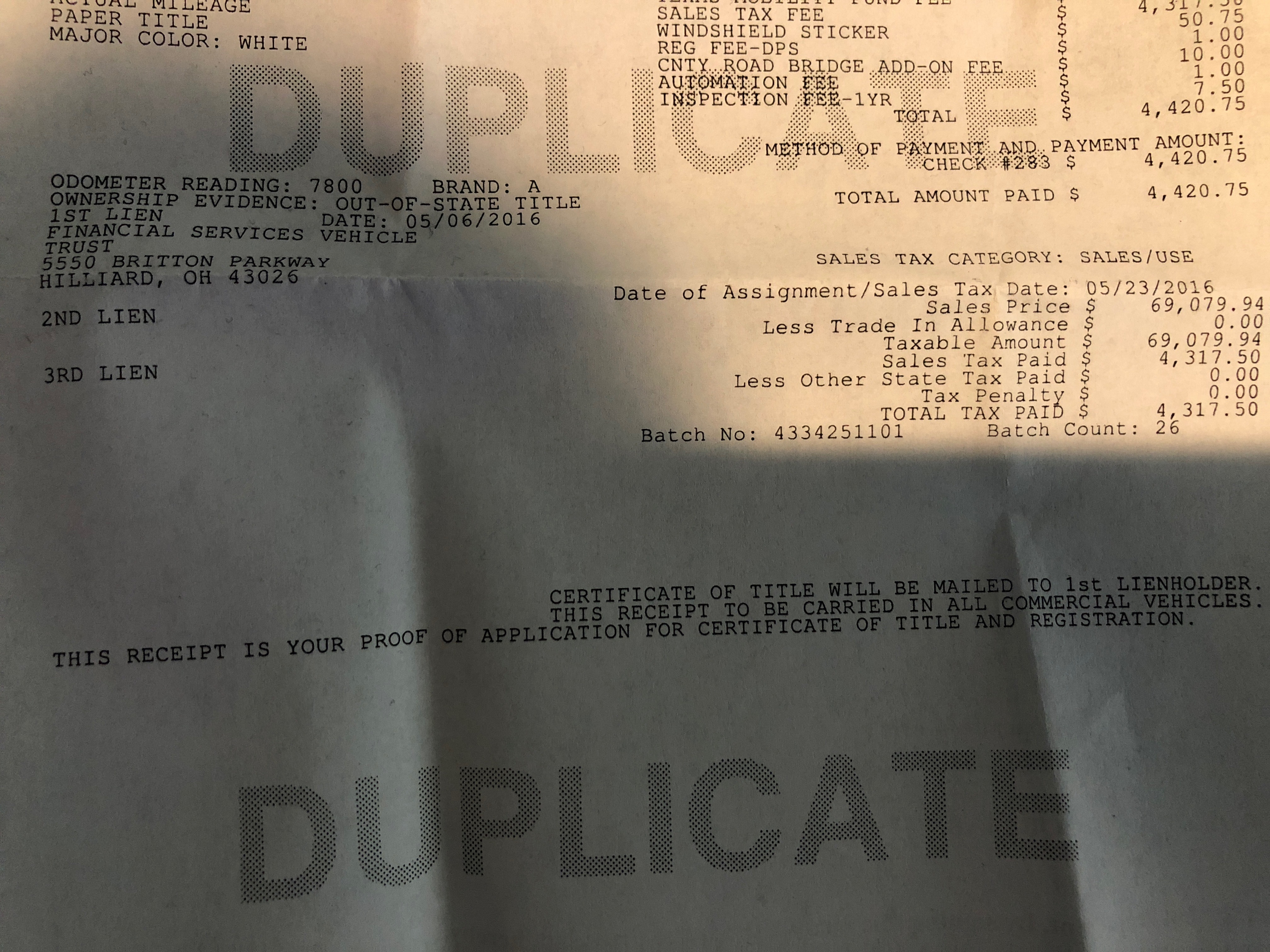

Do You Pay Taxes On A Leased Car. When the vehicle is purchased and titled in Texas the lessor must pay 825 percent sales tax on it. Even if you bought it back from Audi youd still have to pay taxes.

For example in Texas youll have to pay 90 a year in property tax for a car thats valued at 20000. There are a couple of other options to minimise this if you plan to own the vehicle. Yes in Texas you must pay tax again when you buy your off-lease vehicle.

Do I have to pay taxes on a leased car. Yup you pay the tax twice unfortunately or just once if you had tax credits for the initial lease. Even if you refinanced it at UFCU down the street youd have to pay taxes.

Any tax paid by the lessee when the motor vehicle was titled and registered in Texas was paid in the name of and for the lessor. New residents 90 new resident tax due in lieu of use tax on a vehicle brought into Texas by a new resident if the vehicle was previously registered in the new residents name in another. Motor Vehicle Leased Outside Texas by New Resident Titled.

Yes you absolutely have to pay taxes. If you lease a car as a private individual under a personal lease you will have to pay 20 VAT value-added tax. Most states roll the sales tax into the monthly payment of the car lease though a few states require that all the sales tax for all your lease payments be paid upfront.

Instead sales tax will be added to each monthly lease. Do You Pay Taxes On A Leased Car. In other states such as Texas youll have to pay a flat fee each year.

In Texas leases of vehicles are not taxable. Again its important to. Technically there are two separate transactions and Texas taxes it that way.

While you wont necessarily pay the entire amount. All leased vehicles with a garaging address in Texas are subject to property taxes. When you lease a car in most states you do not pay sales tax on the price or value of the car.

There are some available advantages to leasing a vehicle in a business name please. In some states such as Oregon and New Hampshire theres no sales tax at all. For example if your local sales tax rate is 5 simply multiply your monthly lease payment by 5.

The States With The Lowest Car Tax The Motley Fool

What S The Car Sales Tax In Each State Find The Best Car Price

Is There Sales Tax On A Leased Car In Texas

Honda Lease Deals In San Antonio Tx Fernandez Honda

Toyota Gr Supra Lease Prices Pharr Tx Toyota Of Pharr

Kevin Hunt Why Am I Paying Sales Tax On Leased Car S Dmv Renewal Fees Hartford Courant

Buy Or Lease Serves Houston Fred Haas Toyota World

Do Auto Lease Payments Include Sales Tax

How To Lease A Car When You Have Bad Credit Yourmechanic Advice

Tax Advantage Leasing Vs Buying Lancaster Toyota

Is There Sales Tax On A Leased Car In Texas

What To Do At The End Of A Car Lease Yaa

Do Auto Lease Payments Include Sales Tax

Car Tax By State Usa Manual Car Sales Tax Calculator

Is It Better To Buy Or Lease A Car Taxact Blog

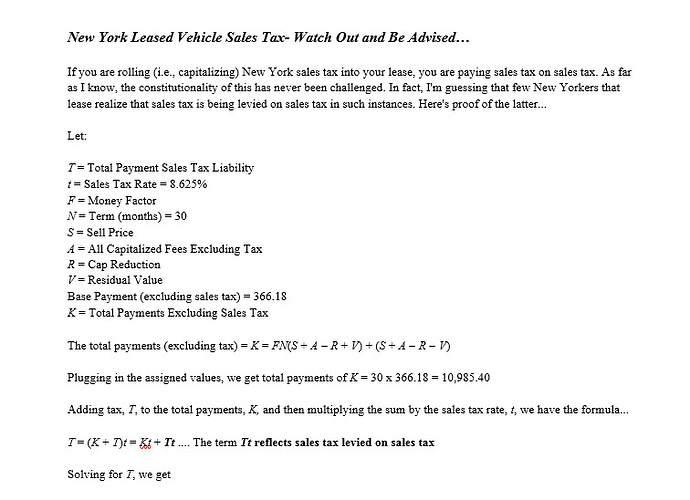

Taxes In New York Ask The Hackrs Forum Leasehackr

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars